It's almost heartening to see them go to these lengths - they're getting a little scared - though I worry how many wingnut media outlets will reference the report as if it's substantive..?

(From the Washington Post)

The Insurance Industry's Deceptive Report

by Ezra Klein

In the hallowed tradition of the tobacco and energy industries, the health insurance industry has commissioned a report (pdf) projecting doom and despair for those who seek to reform its business practices. The report was farmed out to the consultancy PricewaterhouseCoopers, which has something of a history with this sort of thing: In the early-'90s, the tobacco industry commissioned PWC to estimate the economic devastation that would result from a tax on tobacco. The report was later analyzed by the Arthur Andersen Economic Consulting group, which concluded that "the cumulative effect of PW’s methods … is to produce patently unreliable results." It's perhaps no surprise that the patently unreliable results were all in the tobacco industry's favor. He who pays the piper names the tune, and all that.

All that makes it a bit hard to respond to this analysis. Seriously engaging with its methodology probably gives it more credit than it deserves, making this seem like an argument between two opposing sides as opposed to a predictable industry hit job. But totally ignoring its claims means some of them might live unchallenged. So rather than a full tour through the "analysis," here are a couple of its more representative moments.

A footnote -- how come the good stuff is always in the footnotes? -- on page E-2 of the report sort of gives away the game. It reads: "Impact assumes payment of tax on high- value plans, full cost-shifting of cuts to public programs, and full passthrough of new industry taxes." That's written to obscure, but what it means is that the report assumes no behavioral changes in response to new policies.

To illustrate how this works, let's go back to another PWC favorite: tobacco taxes. Imagine Congress slaps a $10 tax on each cigarette purchased in the continental United States. The impact is obvious: People will virtually cease purchasing cigarettes, or the trade will move onto the black market. But a PWC report that "assumes payment of tax" would assume that cigarette purchasing remains unchanged, and smokers fork over $30 bazillion (approximately) in taxes. This would mark the beginning of a heretofore unknown phenomenon: nicotine bankruptcy.

At least, it would in the world of PWC's report. But it wouldn't do so in the real world. So too with these assumptions. Economists think that the tax on high-cost health-care plans will lead employers and consumers to demand cheaper plans that do more to control costs. In fact, PWC expects that, too. They just don't build it into their estimate. On Page 6, they say, "Although we expect employers to respond to the tax by restructuring their benefits to avoid it, we demonstrate the impact assuming it is employed." That's a bit like saying although I expect to eat doughnuts this morning, I will instruct my scale to act as if I had abstained.

Or take the assumption of "full cost-shifting of cuts to public programs." What that means, essentially, is that health-care spending is considered a constant, and every dollar that a public program cuts from its payments to hospitals is a dollar the private health-care industry has to add to its reimbursements to hospitals. Have you ever heard of that before, in any industry? If Blockbuster decides to cut costs to consumers by negotiating lower payments to movie studios, does Netflix send out a sorrowful e-mail explaining that it will have to increase its membership fee because it now needs to make higher payments to movie studios?

Another interesting bit comes on Page 2, which identifies "new minimum benefit requirements that may require people to buy coverage that is more expensive than options to which they currently have access" as one of the "root causes" of coming premium increases. In the footnote, the report complains that the Senate Finance plan requires a minimum 65 percent actuarial value (that is to say, 65 percent of what an individual is expected to need), while the Massachusetts plan only requires a 56 percent actuarial value. Other states have no minimum value. Insurers will also be forced to cover preexisting conditions, have an out-of-pocket limit, and end rescissions.

It's true, as the report says, that buying better insurance will cost somewhat more than buying insurance that doesn't cover anything. The vast majority of the people affected by this will be using subsidies, of course, but put that aside for a moment. This is part of the point of health-care reform: Insurers will no longer have the freedom to offer products that let an individual think his family his protected when the policy will do nothing of the sort. That may raise prices, in much the way that antibiotics cost more than herbal supplements, but it raises prices because it reduces the insurance industry's ability to sell a deceptive and insufficient product.

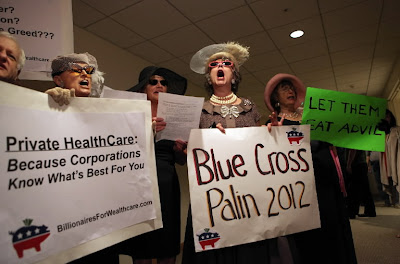

But if the PWC's report doesn't offer much in the way of trustworthy policy analysis, it is an interesting looking at the changing politics of the issue. In short, the insurance industry is getting scared. After many months of quiet constructiveness, they're launching a broadside on the week of the Senate Finance Committee's vote. The White House, which had a pleasant meeting with the industry's leadership last week, was shocked by the report, and so too was the Senate Finance Committee. The era of cooperation seems to be over, and they weren't given much advance warning. But the report might have another impact, too: The evident anger and fear of the insurance industry might do a bit to reassure liberals that this plan is worth supporting, after all.

Photo credit: Justin Sullivan/Getty Images.

Comments